SAN FRANCISCO, UNITED STATES - 2020/01/23: A view of the Grand Hyatt hotel logo seen at one of their ... [+]

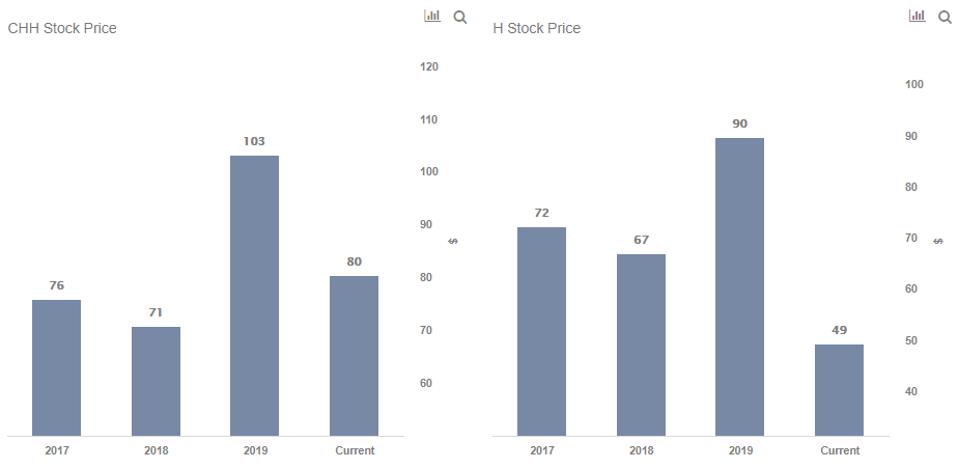

SOPA Images/LightRocket via Getty ImagesHyatt stock (NYSE: H) has declined by close to 40% since early February after the WHO declared the coronavirus disease a global health emergency, while Choice Hotels CHH’ stock (NYSE: CHH) has fared slightly better and lost only 20% of its value. Lockdown measures and social distancing norms have significantly affected the travel & tourism industry across the world. More so, the hotel occupancy rates have fallen off the cliff triggering fears of a prolonged downturn for the sector. Royalty or franchise fees, which are charged as a percentage of third-party hotel revenues, contribute a major chunk of both hotel operator’s earnings. In fact, Choice Hotels’ franchising business contributes 97% of the total revenues. While the expansion of the total room portfolio is a key factor supporting earnings growth, Trefis believes that Hyatt is likely to gain more with the recovery in travel demand as compared to Choice Hotels primarily due to a low current valuation multiple (EV/EBITDA).

Our conclusion is based on our detailed dashboard analysis, Is Choice Hotels Expensive Or Cheap vs. Hyatt Hotels? wherein we compare trends in key metrics for the two hotel companies over the years to determine their relative valuations under the current circumstances. We summarize parts of this analysis below.

Why Has Choice Hotels Outperformed Hyatt Over Recent Months?

Choice Hotels’ EV/EBITDA based on 2019 earnings has declined from over 18x in 2019 to 15.4x currently, while Hyatt’s multiple has declined from 14.6x to about 9.5x. The steeper decline in Hyatt’s multiple can be mostly attributed to its lower EBITDA margin.

However, Choice Hotels’ multiple still appears high, considering that the company’s revenues and margins also face the same systemic risk of a prolonged slump in travel demand compared to Hyatt. Notably, Hyatt’s EV/EBITDA is at the lowest level in the past three years, but Choice Hotels’ EV/EBITDA is around the same level seen at the end of 2017 - hinting that a market correction could happen if travel restrictions are not eased due to the second wave of the pandemic.

But How Long Will The Hotel Industry Remain Under Pressure?

The expected timeline for recovery in global economic conditions, and in travel demand, hinge on the broader containment of the coronavirus spread. Our dashboard forecasting US Covid-19 cases with cross-country comparisons analyzes expected recovery time-frames and possible spread of the virus. Further, our dashboard -28% Coronavirus crash vs. 4 Historic crashes builds a complete macro picture and complements our analyses of the coronavirus outbreak’s impact on a diverse set of Choice Hotels’ multinational peers, including Hilton and Hyatt. The complete set of coronavirus impact and timing analyses is available here.

As travel demand remains subdued, are Covid-19 Treatment Stocks a better bet? We highlight the stock performance of Regeneron Pharmaceuticals REGN , Gilead Sciences GILD , Amgen AMGN , and Alexion Pharmaceuticals in another dashboard.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

The Link LonkJuly 31, 2020 at 05:00PM

https://ift.tt/3hXfwcv

Choose Hyatt Over Choice Hotels When Signs Of Travel Return - Forbes

https://ift.tt/31vRPml

Travel

No comments:

Post a Comment